With the transition from traditional Sales Recording Modules (MEV) to the new MEV-Web, Quebec’s restaurant industry is undergoing a significant technological shift. Spearheaded by Revenu Québec, this change aims to modernize tax data collection while simplifying transaction management for restaurant owners. But what are the real implications for businesses in the sector?

1. Moving to a Digital Solution

Unlike the physical MEV devices, MEV-Web is entirely digital. This means restaurant owners must integrate a compatible point-of-sale (POS) system with the new platform. Those still relying on traditional cash registers may need to invest in an upgraded or entirely new system.

One of the biggest advantages of this transition is the elimination of bulky hardware and the maintenance costs associated with MEV devices. With MEV-Web, everything is handled directly through software connected to Revenu Québec’s servers.

2. Less Paperwork, More Efficiency

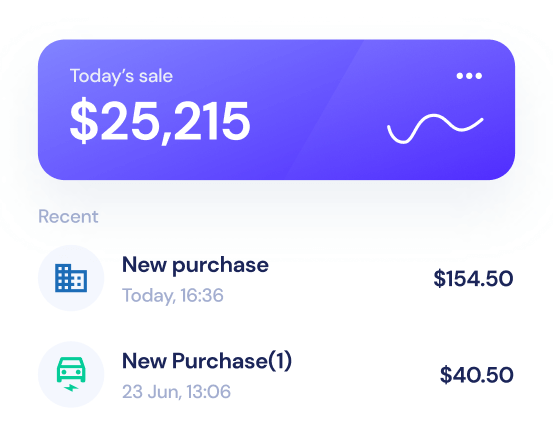

MEV-Web automates the transmission of sales data to Revenu Québec in real-time or on a scheduled basis, reducing administrative tasks for restaurant owners. This ensures better sales tracking and minimizes reporting errors.

Additionally, mandatory paper receipts could become less common as the system allows for electronic receipts, offering an eco-friendly and convenient alternative for customers.

3. Strengthened Tax Compliance

One of MEV-Web’s primary goals is to reduce tax evasion and improve transaction transparency. Restaurateurs must ensure their systems meet the new requirements to avoid penalties. This includes using certified software and training staff on updated procedures.

While MEV-Web simplifies administrative processes, it also demands stricter data management and transaction tracking.

4. Implementation Challenges

Despite its benefits, transitioning to MEV-Web comes with some challenges for restaurateurs:

- Adoption Costs: Some businesses may need to upgrade their POS systems or adopt entirely new ones.

- Staff Training: Employees must be trained on the new MEV-Web functionalities.

- Stable Internet Connection: Since MEV-Web relies on digital data transmission, a reliable internet connection is crucial to avoid service disruptions.

5. An Opportunity for Business Modernization

Beyond tax compliance, adopting MEV-Web presents an opportunity for restaurants to modernize their operations. Choosing an advanced POS system can unlock additional benefits such as real-time inventory tracking, automated order management, and enhanced sales analytics.

Conclusion

The transition to MEV-Web represents a significant shift for Quebec’s restaurant industry. While the adjustment period may pose some challenges, it also offers opportunities for greater efficiency and modernization. The key to success lies in selecting the right POS software and ensuring staff are well-prepared for this digital shift.